Exploring DEX Screener's Impact on User Safety and Ethical Practices in DeFi

Examining DEX Screener: Navigating Risks and Ensuring User Safety in DeFi

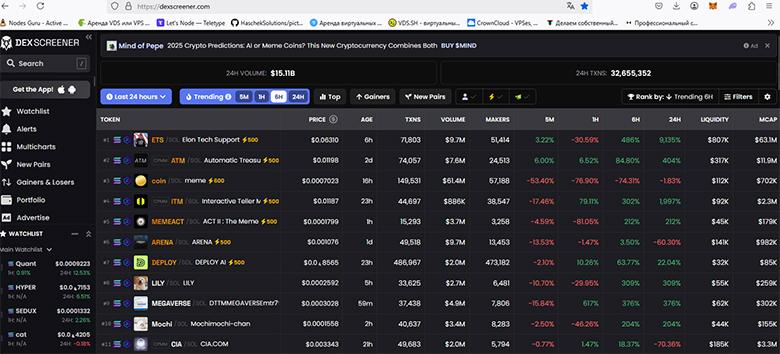

DEX Screener has emerged as a pivotal platform for tracking tokens on decentralized exchanges (DEXs), especially in the rapidly evolving decentralized finance (DeFi) sector. While it offers valuable tools for traders and investors, recent criticisms regarding its business practices call into question the platform's integrity and user safety. This article delves into the implications of these criticisms, analyzing the current practices of DEX Screener and providing insight into how investors can navigate this complex landscape responsibly.

Overview of DEX Screener and Its Role in the Crypto Ecosystem

DEX Screener emerged in 2021 as a pivotal tool in the decentralized finance (DeFi) landscape, designed to streamline the process of tracking and analyzing tokens across various decentralized exchanges (DEXs). Created by Alexandre Bini and Andreas Diegues, it caters to a diverse range of blockchains including Ethereum, Solana, and Base, providing real-time data on token prices, liquidity, and historical performance charts. This functionality proves indispensable for traders seeking to identify and invest in emerging tokens before they achieve mainstream recognition, thus playing a significant role in the broader cryptocurrency ecosystem [Source: Crypto News].

As the DeFi movement has evolved, so too has DEX Screener's functionality. Initially embraced for its user-friendly interface and comprehensive token analysis capabilities, the platform has grown to serve a critical need within the increasingly complex financial landscape of cryptocurrencies. DEX Screener facilitates the monitoring of market trends and performance, enabling traders—both seasoned and novice—to make informed decisions based on up-to-date information regarding liquidity and token viability [Source: Immigration News Canada].

However, despite its significance, DEX Screener has found itself at the heart of controversy due to allegations of promoting scam tokens through a fee-based listing model. Reports suggest that the platform generates over $250 million annually primarily from token creators seeking enhanced visibility through paid listings. Critics, including industry figures like Conor Grogan from Coinbase, argue that this revenue strategy compromises the platform's original intent, potentially putting users at risk by presenting fraudulent tokens ahead of legitimate ones [Source: Crypto News]. Such practices raise critical ethical concerns regarding user safety, particularly affecting less experienced traders who may inadvertently invest in scams due to the misleading appearance of certain listings.

Consequently, DEX Screener's evolving role within the DeFi ecosystem highlights the delicate balance between facilitating access to new projects and maintaining the integrity of the information disseminated to users. While it remains a valuable tool for monitoring DeFi activity, addressing the ongoing issues related to transparency and user protection is essential for preserving its credibility and utility in a rapidly evolving space [Source: Bitbond].

The Business Model Behind DEX Screener

DEX Screener operates on a business model primarily focused on generating revenue through fees associated with token listings and promotional services. One of the core elements of this model is the substantial fee structure that can reach up to $100,000 for token promotion, providing projects with visibility by placing them at the top of search results and homepage recommendations [Source: Crypto News]. This practice allows token creators to amplify their visibility but raises questions about the integrity of the tokens being promoted.

In addition to promotional fees, DEX Screener charges fees for updating token branding and relevant information. Data indicates that this model can generate upwards of $250,000 in daily revenue, translating to an annual figure exceeding $250 million, which includes more than $50 million attributed to these fees alone [Source: Crypto News]. The revenue derived from these ventures underscores the platform's financial success, yet highlights a critical challenge. As it prioritizes paid listings to bolster profit margins, DEX Screener faces scrutiny for potentially compromising user safety and the legitimacy of tokens presented to its audience.

The process for listing tokens on DEX Screener is relatively straightforward; tokens simply need to establish a liquidity pool and execute at least one transaction. This automated approach facilitates rapid onboarding of new tokens, providing immediate accessibility to users [Source: Crypto News]. However, this efficiency comes at a cost: tokens promoted through financial incentives may overshadow legitimate projects. As Conor Grogan, a product executive at Coinbase, pointed out, the platform's front page is often inundated with promoted scam tokens, diminishing the visibility of trustworthy offerings [Source: Crypto News].

This tension between profit maximization and consumer safety raises pertinent ethical questions about the future direction of DEX Screener’s business practices. The impact on the integrity of listed tokens could have lasting implications for the trust users place in the platform, demonstrating the need for a balance between revenue generation and safeguarding user interests.

Criticism and Controversy: Allegations of Scam Token Promotion

The controversies surrounding DEX Screener have intensified, particularly regarding allegations of its role in promoting scam tokens. Critics, including notable figures such as Conor Grogan from Coinbase, have raised concerns about the platform's prioritization of paid listings over legitimate projects. This practice purportedly allows token creators to pay for prominent placements that can mislead users, pushing low-quality or fraudulent tokens to the forefront of the platform’s visibility [Source: Binance].

A closer examination reveals that these paid promotions significantly contribute to user deception, particularly among inexperienced investors who may not adequately scrutinize the listings. Reports suggest that the majority of the front page on DEX Screener is filled with promoted bundles of tokens, many of which have been flagged as scams [Source: Crypto News]. This prioritization raises serious questions about the platform’s responsibility towards its users and the overall integrity of the token listing process.

Financial motivations cannot be overlooked; the platform reportedly generates over $250 million annually from such paid listings, indicating a strong incentive to continue this approach despite the risks it poses to investors [Source: Mitrade]. This scenario exemplifies a profound conflict of interest, wherein the imperative for profit may overshadow user safety and the promotion of credible token projects.

Industry observers highlight that while the crypto domain has always been susceptible to deceptive practices, DEX Screener's aggressive promotion of tokens that lack adequate verification measures poses unique threats to investor trust. Users and token companies are often subjected to a verification process, including KYC compliance; however, the effectiveness of these measures has come into question. Many gathered complaints suggest a recurring issue where recently promoted tokens turn out to be either scams or of significantly low quality [Source: NewsBTC].

Ultimately, the implications of DEX Screener's practices resonate through the broader crypto landscape, calling into question the fundamental principles of transparency and accountability in token listings. This evolution underscores the necessity for holistic reforms within the industry to safeguard user investment and enhance trust.

Navigating Risks: Best Practices for Investors on DEX Screener

Investing in cryptocurrencies, particularly through platforms like DEX Screener, requires a strategic approach to minimize risks and maximize potential rewards. As the market continues to evolve, adhering to best practices is essential for safeguarding investments.

One crucial strategy involves verifying smart contract audits. Reputable auditors like Consensys or SolidProof conduct audits that validate the integrity of a token’s code. Investors can search for a token's contract address on DEX Screener and check for an “Audit” button, which indicates whether an audit has been performed. If the audit raises red flags, it’s advisable to avoid such investments [Source: CryptoNews].

Locked liquidity pools are another key indicator of a token's legitimacy. A liquidity pool that is locked prevents developers from withdrawing funds, reducing the risk of rug pulls. On DEX Screener, investors should look for a lock icon next to the liquidity figure to confirm this safeguard [Source: CryptoNews].

The engagement level of the community surrounding a token can also reveal its authenticity. It's important to check social media platforms for genuine activity, such as meaningful comments and likes. A high number of followers with little engagement may suggest the presence of bots or fake accounts [Source: CryptoNews].

Diversification remains a fundamental tenet of investment risk management. By spreading investments across different projects and ecosystems, investors can protect themselves against significant losses if one particular asset underperforms [Source: CryptoNews].

Investors are also encouraged to utilize advanced filters and metrics available on DEX Screener. Customizable screeners enable users to filter tokens based on liquidity, market capitalization, trading volume, and transaction counts, making it easier to identify viable investments [Source: CryptoNews].

However, caution is warranted when considering promoted listings, as these can sometimes favor scams over legitimate projects. Investors should always perform additional research outside of DEX Screener, examining the project’s website, whitepaper, and roadmap [Source: CryptoNews].

Monitoring real-time data and avoiding FOMO (Fear of Missing Out) are essential practices. Price alerts and watchlists can keep investors informed, while prudent decision-making can help them avoid impulsive investments driven by hype [Source: CryptoNews].

By employing these best practices, investors can enhance their ability to navigate the DEX Screener and mitigate potential risks associated with cryptocurrency investments.

Future Perspectives on DEX Screener's Impact in the Crypto World

The future of DEX Screener in the rapidly evolving cryptocurrency landscape raises several pressing considerations. As the platform continues to grow, it must navigate inherent challenges associated with user trust, regulatory scrutiny, and the integrity of its listings. Emerging trends in decentralized exchanges (DEXs) indicate an increasing demand for transparency and security among users, which places additional pressure on platforms like DEX Screener to adapt accordingly. The rise of synthetic assets, yield farming, and decentralized finance (DeFi) protocols demands a robust tool that not only delivers data but also fosters user safety through reliable listings.

Acknowledging the criticisms surrounding the promotion of scam tokens through paid listings, DEX Screener faces an imperative to reassess its business model. Reports suggest that the platform has generated upwards of $250 million annually through promotions that may prioritize profit over user safety, sometimes at the expense of integrity in token listings [Source: Crypto News]. This has led to a decline in user trust, as many token promotions are deemed low-quality or outright fraudulent. Thus, the platform's future viability heavily relies on reestablishing a reputation for integrity by possibly reworking its fee structure.

Regulatory changes loom on the horizon; regulators are increasingly scrutinizing platforms that fail to adequately protect investors from scams. As potential regulations increase, DEX Screener must align its operations with best practices to maintain compliance and user confidence. The integration of more comprehensive vetting processes for tokens prior to listing—balancing promotional offerings with stringent checks—could serve as a valid response to enhance user safety.

Furthermore, expanding educational resources and tools on the platform could empower users to make informed decisions, fostering a culture of diligence and awareness. By harnessing advanced analytics and user feedback, DEX Screener could revolutionize the way it navigates the crypto landscape, ensuring that it meets the evolving needs of its user base while maintaining ethical responsibility in token promotion.

Ultimately, while the technical capabilities of DEX Screener are commendable, its future hinges on the platform's ability to uphold user trust and safety in light of mounting scrutiny.

Conclusions

In summary, DEX Screener serves as a vital resource in the decentralized finance ecosystem, but not without significant caveats. As the platform continues to grow, both traders and investors must remain vigilant, critically examining token listings and understanding the inherent risks. By employing best practices and leveraging available resources, crypto enthusiasts can better protect themselves from potential scams while benefiting from the insights DEX Screener provides. The dialogue around ethical practices in decentralized exchanges will be crucial for the future of crypto trading.

Sources

- Bitbond - Token Terminal: The Ultimate Guide

- Crypto News - How DEX Screener Became a Hub for Crypto Scammers

- Immigration News Canada - The Role of Crypto Exchanges in Facilitating Decentralized Finance (DeFi)

- Mitrade - DEX Screener and Scam Tokens

- NewsBTC - Memecoin Scam Alert

- Binance - Warning Issued Over Fake Kaito Tokens on DEX Screener

- Tokenomics & Market Trends

- Blockchain Technology Insights

- Token Launches & Updates

- Crypto & Token Holder Rewards

- Investor Education & Strategies

- Community Spotlight & Success Stories

- Regulation & Compliance

- Security & Wallet Protection

- Innovative Use Cases & Partnerships

- Future of Tokens & Blockchain

- Token Stories & Case Studies

- Ask the Experts

- Networking

- Other